Planning Opportunities

SAMPLE CLIENT: MALE, AGE 50

RATE CLASS: PREFERRED NON-SMOKING

INCOME TAX RATE: 35%

ASSUMED RATE OF RETURN: 7.00%

THE IUL SOLUTION

The client chooses to buy permanent life insurance to protect their estate and family. The policy’s cash value accumulates quickly through tax-deferred growth, and the client has access to the cash value income tax-free for college tuition or retirement income. Unlike other options, funds can be withdrawn from the life insurance policy prior to age 59½ without penalty and the policy does not require mandatory distributions by age 70½.

- Market return (results) without

- Flexibility to determine annual contribution amounts and when to take distributions

- The benefits of personal ownership – the policy belongs to the participant regardless of employment status

- Policy values are creditor protected in most states

- Flexibility – program offers planning options in the form of policy riders that can tailor benefits to address unique needs and objectives

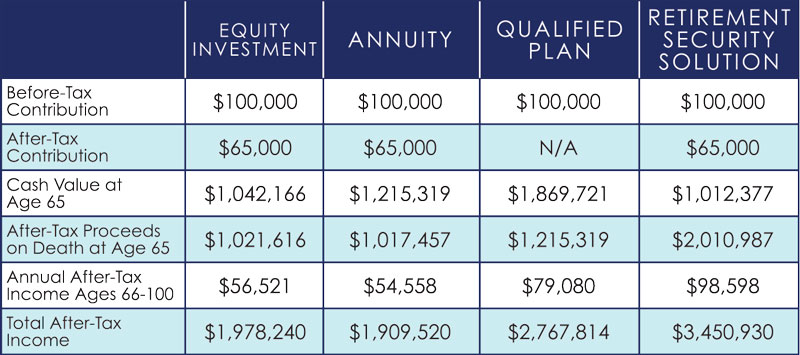

You have a variety of options when it comes to planning for your retirement. Let’s discuss the advantages and drawbacks of the most common strategies.

EQUITY INVESTMENTS

Equity investments can provide liquidity for retirement income and other financial needs, as well as the ability to diversify your investment mix. Yet income and capital gains taxes can reduce investment returns. Since equity investments are purchased with after-tax dollars, income taxes have to be paid on earnings, short-term capital gains and portfolio turnover. Capital gains taxes may also be payable when shares are sold.

ANNUITIES

Annuities offer the power of tax-deferred growth and the ability to diversify investments. Any withdrawals taken from an annuity prior to age 59½ are generally subject to income taxes, plus a 10% federal tax penalty. What’s more, only a portion of the income taken at retirement can be received tax-free; all contract earnings are subject to full income taxation.

QUALIFIED PLANS

Qualified Pension Plans and IRAs are probably the most popular accumulation vehicles available today. They offer tax-deductible contributions and tax-deferred growth, two very important considerations. However, there are drawbacks to qualified plans:

- Income at retirement is fully taxable

- Regulations limit how much you can set aside on an annual basis

- Distributions are required at specified ages

EQUITY INDEXED UNIVERSAL LIFE

Equity Indexed UL products offer tax-deferred accumulation, income tax-free funds at retirement, and no government limitations on how much you can contribute annually. Only life insurance offers permanent death benefit protection and your plan is self-completing should you die prior to retirement. Many policies also offer option riders that provide protection in the event of disability.