Introduction

One of Wealth Concepts’ most valuable assets is its marketing powerhouse. Start with access to custom illustrations from virtually any carrier through Wealth Concepts, add personally branded materials for your business – and state-of-the-art email delivery and tracking technology that ranks your leads based on their activity.

- Advanced sales strategies

- Email campaigns

- Point-of-sale brochures

- Supplementary flyers

- Additional sales support materials

- Stationery

- Company brochures

- Promotional items

Virtual Concierge

Wealth Concepts Marketing’s Virtual Concierge service is the perfect solution for any producer or agency. It is the outsourced equivalent of an entire marketing department – at a fraction of the cost. Just sit back, relax and your Virtual Concierge do the work for you.

- Strategic marketing plan

- Plan execution

- Lead scoring

- Custom “one-off” emails

- Custom landing pages

- Always a phone call or email away

The Virtual Concierge service includes not only implementing the strategy we will have so carefully crafted – but also state-of-the-art marketing automation.

Marketing Automation

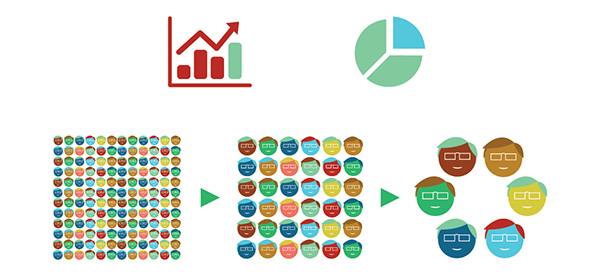

It’s a process by which we take your contact list – no matter how big or small – and convert that list into a concentrated group of leads.

For example, say you have a list of 3,000 emails. We begin your campaign with powerful, eye-catching messaging that, on average, brings in 15% open rate, which is among the highest in the e-marketing industry. We bait the email with alluring, visually appealing buttons, which draw the viewer’s attention and lead to clicks. But we don’t stop there…

Your Virtual Concierge runs tracking reports for every email you send, all the while quantifying and qualifying only the best leads from your original list of 3,000. The result, after just one campaign, is a handful of hot leads: contacts who have blatantly and consistently shown interest – and who are prime to receive direct contact from you.

It’s only at this point that you’re required to take an action: either a direct email or phone call. It’s not a cold call; this person already knows you and what you’re about to talk about.

And that’s if they haven’t already contacted you directly! Our clients receive anywhere from 6 to 20 contact-me request forms or direct replies to their emails.

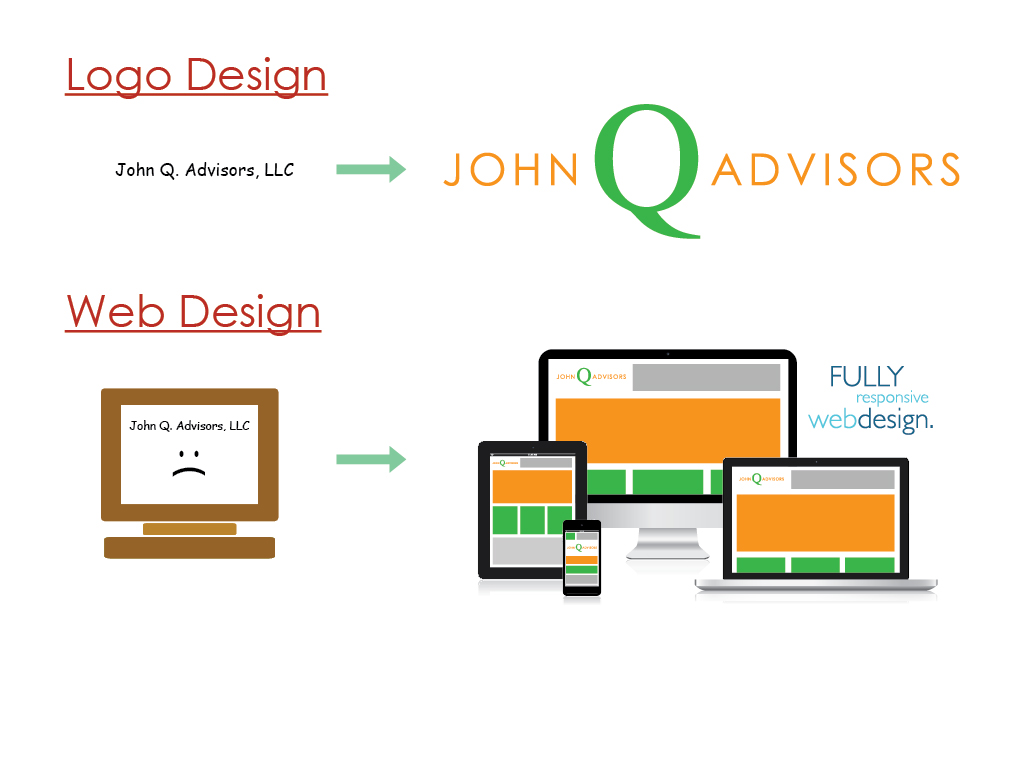

BRANDID

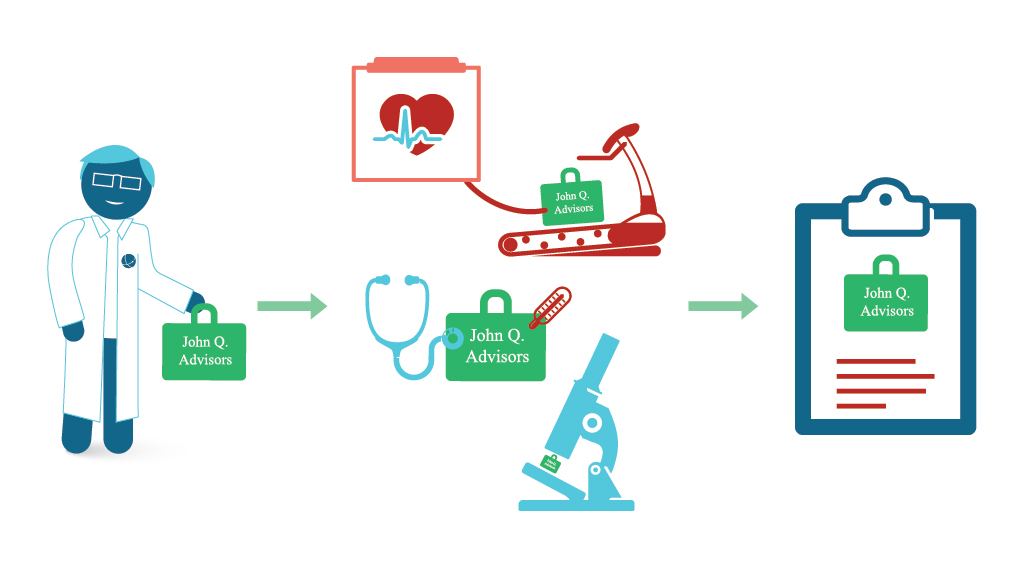

You send us everything you have that touches your audience: logo, stationery (business cards, letterhead, envelope, email signature), brochures, flyers, handouts, emails, link to your website, etc.

Our branding experts evaluate the quality, consistency and overall aesthetic presentation your company presents to the marketplace.

Finally, we deliver our assessment of your company’s branding with a list of recommendations regarding what steps should be taken. It’s the strategic marketing equivalent of getting a physical.

Our designers can create a whole new image for your business. We know that some may not see the value in superior branding. But we assure that those around you, if they haven’t already, are starting to see the value in presenting your company in the best possible way. You don’t want to get left behind.

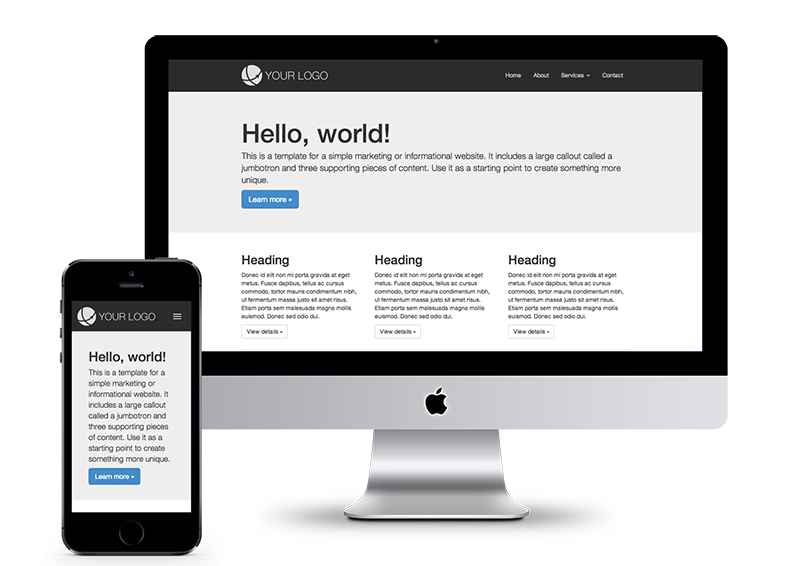

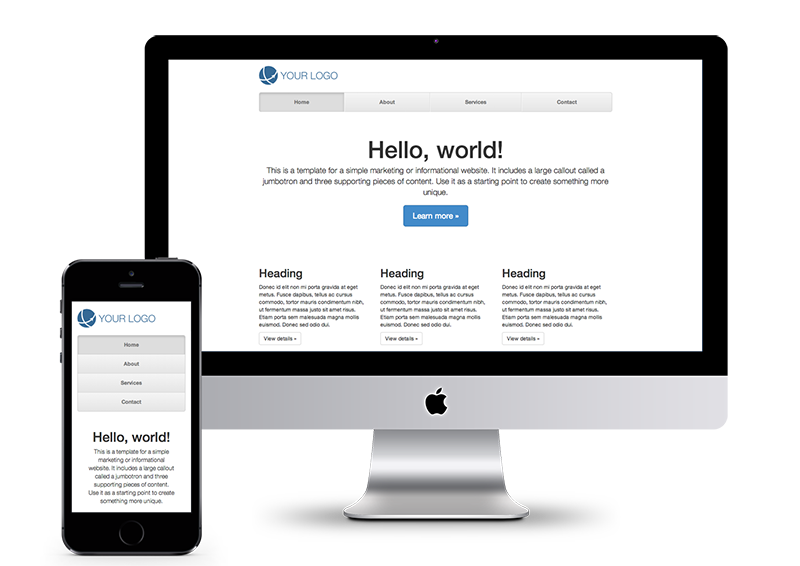

Web Design

We also offer two web templates that are for marketing your company and important information – keeping your audience up to date and engaged. We will cusotmize the site to fit your brand in no time!

Concepts

Life Insurance Audit

As life changes and economic conditions change it is important to verify that financial plans are keeping up with current needs and meeting desired objectives.

Target Profile:

Any individual or business owner that currently owns life insurance

Included:

- Email campaigns

- Direct mail letter

- Supporting phone script

- Point-of-sale brochure

- Supplementary marketing materials

- Evaluation and Analysis template

- Information Release Form

- Change Agent of Record Form

Executive Bonus Program

Executive Bonus is a non-qualified benefit plan designed to:

- Attract, reward, and retain key employees

- Create income tax-deferred growth

Target Profile:

Business owners who…

- can’t save enough within a qualified plan

- are looking for a benefit to attract candidates

- have existing key employees they want to reward and retain

- want additional life insurance for themselves and their key employees

- are concerned about future tax rates

Included:

- Email campaigns

- Direct mail letter

- Supporting phone script

- Point-of-sale brochure

- Supplementary marketing materials

PRO Save

A strategy to create or supplement protection and savings needs using cash value life insurance.

Target Profile:

- Individuals ages 30 to 50 who may want:

- Income-tax free death benefit protection

- Tax deferred growth on cash value

- Tax-free retirement income

- Creditor protection

Included:

- Email campaigns

- Direct mail letter

- Supporting phone script

- Point-of-sale brochure

- Supplementary marketing materials

Legacy Planning

Legacy planning is the process of positioning assets that are not needed during a person’s lifetime so that they may be transferred in an efficient manner to the next generation and/or charity.

Target Profile:

- Individuals age 55+

- Affluent (have assets not needed for retirement)

- Concerned with:

- Market volatility

- Investment performance

- Erosion of taxes

- Beneficiaries unprepared to manage money

Included:

- Email campaigns

- Direct mail letter

- Supporting phone script

- Point-of-sale brochure

- Supplementary marketing materials

Enhanced Retirement Trust

An Enhanced Retirement Trust (ERT) utilizes a specially designed trust to provide income-tax free income for retirement as well as tax free (both income & estate) death benefits.

Target Profile:

- Individuals at or nearing retirement (55+)

- Need the ability to access tax-free income

Included:

- Email campaigns

- Direct mail letter

- Supporting phone script

- Point-of-sale brochure

- Supplementary marketing materials

Premium Finance

Premium financing is an arrangement in which money is borrowed from a third-party lender to pay life insurance premiums. It is a cost-effective and tax-efficient method for clients to pay life insurance premiums without having to reduce current cash flow or liquidate assets.

Target Profile:

- Individuals or business with significant assets

- Have a need for life insurance

- Minimum net worth of $5 million

- Anticipated policy premiums of $100,000 per year

- Earning an investment return on assets above that of loan interest rate

Included:

- Email campaigns

- Direct mail letter

- Supporting phone script

- Point-of-sale brochure

- Supplementary marketing materials

.jpg)